Marketing adds fascination to a brand, which in turn adds value.

When a brand is fascinating, people will make greater efforts to find it, have higher engagement with it, and they will stay more loyal, says Sally Hogshead, brand guru and author of “Fascinate: Your 7 Triggers to Persuasion and Captivation.”

“Fascination is an intense emotional focus,” says Hogshead, when your brain is completely focused on one thing without distraction.

This allows people to realize their greatest achievements and be the most effective, similar to when an athlete is “in the zone,” she explains. “Your brain is hardwired to fascinate and your brain is hardwired to be fascinated.”

Marketing adds fascination to a brand, which in turn adds value. By tapping into the “seven triggers of fascination,” credit unions can command members’ attention, build member trust and loyalty—and see bottom-line growth as a result.

Hogshead’s seven triggers of fascination are:

- Power: Take command.

- Passion: Attract with emotion.

- Mystique: Arouse curiosity.

- Prestige: Increase respect.

- Alarm: Create urgency.

- Rebellion: Change the game.

- Trust: Build loyalty.

“Every time you communicate, you’re using one of these seven triggers,”” Hogshead says. “The question is, are you using the right trigger in the right way to get your desired results?”

She says everyone is born with a primary trigger. When that trigger is combined with one of the seven secondary triggers (which are the same), there are 49 different personality combinations of how people fascinate the world around them, each with a different name.

For example, the primary “power” trigger combined with the secondary “passion” trigger results in The Ringleader (think Richard Branson). “Power” plus “trust” creates The Guardian (Warren Buffett); “power” and mystique” yields The Mastermind (Mark Zuckerberg).

For credit unions, understanding the 49 personality types can help managers put people in the right place in the organization, she says.

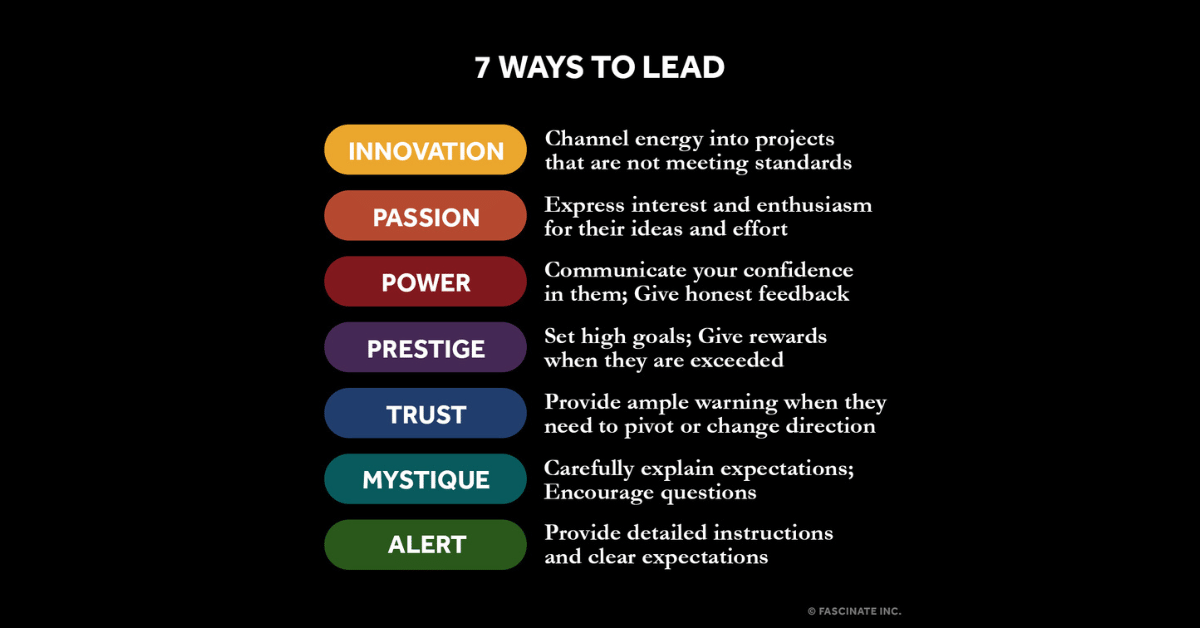

Hogshead says certain primary triggers are associated with particular roles in the organization:

Power: A decision-maker with big goals.

Passion: A relationship builder with consistency.

Mystique: Solo intellect behind the scenes.

Prestige: Over-achiever with high standards.

Alarm: Precise detail manager.

Rebellion: Innovative problem-solver.

Trust: Stable team player.

Credit unions should think long-term about how they can serve members one year from now and 10 years in the future, Hogshead advises. “The greatest value you can add to your organization is to be more of yourself.”

Hogshead addressed the America’s Credit Union Conference in San Diego.